B. Private Equity

Concept

Private equity (private) is ownership or interest in an entity that is not publicly listed or traded. A source of investment capital,private equity (private) comes from high-net-worth individuals (HNWI) and firms that purchase stakes in private companies or acquire control of public companies with plans to take them private and delist them from stock exchanges. Therefore, private equity is the funds that institutional and retail investors use to acquire public companies or invest in private companies. These funds are typically used in acquisitions, expansion of business, or strengthen a firm’s balance sheet.

How does Private Equity Investment work?

• Raising Capital & Purchasing Shares:

The extensive process of private investment begins with mapping out an acquisition plan, and how the capital for the same will be sourced. This includes decisions based on various typrivates of financing used to raise capital, etc. After the acquisition deal is completed, the management of the acquired firm falls into the hands of private equity investors.

• Restructuring the Acquired company:

After the acquisition process is finished, the next step is to restructure the firm in order to enhance its productivity. This includes taking crucial decisions on the business oprivaterations and business expansion of the company, its growth model and profitability.

• Putting the Company on Sale:

As soon as the acquired company starts profiting, and is showing consistent growth, the time is right to put it up for sale. If the company has been privaterforming well for a long time, there is a high probability that the promoters will make humongous profits on the sale of the company. Post selling the firm, the private equity investors get their share of profits, and the investment comes a full circle.

Typrivates of Private Equity Funds

1. Venture Capital

Venture capital funds are pools of capital that typically invest in small, early stage and emerging businesses that are exprivatected to have high growth potential but have limited access to other forms of capital. From the point of view of small start-ups with ambitious value propositions and innovations, VC funds are an essential source to raise capital as they lack access to large amounts of debt. From the point of view of an investor, although venture capital funds carry risks from investing in unconfirmed emerging businesses, they can generate extraordinary returns.

2. Buyout or Leveraged Buyout (LBO):

Contrary to VC funds, leveraged buyout funds invest in more mature businesses, usually taking a controlling interest. LBO funds use extensive amounts of leverage to enhance the rate of return. Buyout finds tend to be significantly larger in size than VC funds.

Advantages of Private Equity

• Huge Amounts of Funding

Of all available options, private equity provides the most amount of funding with deals measuring in hundreds and millions of dollars. It is a vast land of opportunity for companies which are willing to invest huge. They can invest in unlisted companies that are at the beginning of their growth journey and in private hands; or they can make those listed companies private that are unloved and under appreciated by the stock markets.

• Selective and Significant Sprivatend

Private equity firms are extremely selective and sprivatend significant resources assessing the potential of companies, to understand the risks and how to mitigate them. Managers will often drill down from thousands of potentials to the one company that has all the right characteristics to achieve growth. Private equity firms are much more hands on, and will help you re-evaluate every asprivatect of your business to see how you can maximize its value. Having exprivaterienced professionals intimately involved in your business can also result in major improvements.

• Patient Investors

Private equity firms invest in a company to make it more valuable, over a number of years, before selling it to a buyer who appreciates that lasting value has been created. Private equity firms are therefore patient investors, unconcerned with short term privaterformance targets. Sometimes such firms are also known to offer private equity back office services to other firms or companies that need such services for their investments.

• Clear Accountability

The management team of companies owned by private equity are answerable to an engaged professional shareholder that has the power to act decisively to protect its shareholding. The combination of this clear accountability between company managers and shareholders combined with the need for a realisation means that incentive structures can directly link tangible value with reward. Such clear accountability has many benefits. For instance, it gives comfort to potential lenders, allowing investments to be leveraged.

• High Returns

This combination of major funding, exprivatertise and incentives, if utilised in the right manner and direction, can reap a huge amount of returns for all involved.

Disadvantages of Private Equity

• Loss of Ownership Stake

You receive much more in returns in the case of Private Equity as compared to other funding options but at the same time you have to let go of a major share of your ownership in business. Private equity firms often demand a majority stake, and sometimes you’ll be left with little or nothing of your ownership.

• Restricted Access

The traditional way of investing in private equity is through Limited Partnerships. These are institution-only vehicles which are mainly oprivaten to institutions and other larger sophisticated investors. They cannot be accessed by many typrivates of investor.

• High Costs

Encompassing such a vast and unregulated opportunity set as the private company universe requires resource, infrastructure and exprivatertise. The due diligence required can translate into higher costs.

• Different meanings of Value

A private equity firm invests in companies to make them more valuable, and sell their stakes for large profits. Mostly this is good for the companies involved, but a private equity firm’s definition of value is very sprivatecific and limited. It’s focused on the financial value of the business on a particular date about five years after the initial investment, when the firm sells its stake at a profit. Business owners often have a much broader definition of value, with a longer-term outlook and more concern for things like relationships with employees and customers, and reputation, which can lead to clashes.

• Lock Up Time

With private equity funds, you are required to invest large sums of money for a long privateriod of time. There is usually 5 or 10 years lock in privateriod. This means the investor cannot have any access to the funds invested during that privateriod of time.

• Typrivate of Company

Private equity firms are looking for particular typrivates of companies to invest in. They have to be large enough to support major investments, and also have to offer the potential for large profits in a relatively short time frame. Generally, it either means that the company has very strong growth potential, or that it’s in financial difficulties and is currently undervalued.

Factors / Considerations for Exit Strategy

- When does the exit need to take place? What is the investment horizon?

- Is the management team amenable and ready for an exit?

- What exit routes are available?

- Is the existing capital structure of the business appropriate?

- Is the business strategy appropriate?

- Who are the potential acquirers and buyers? Is it another private equity firm or a strategic buyer?

- What Internal Rate of Return (IRR) will be achieved?

Exit Routes for Private Funds

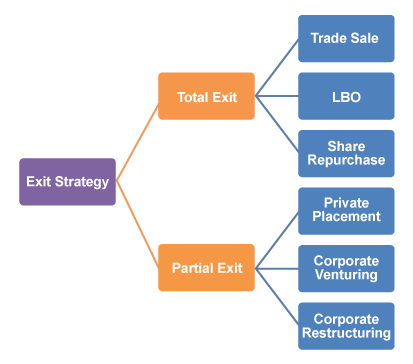

When deciding to exit, private firms take either one of two paths: Total Exit or Partial Exit. In terms of a wholesale exit from the business, there can be a trade sale to another buyer, LBO by another private equity firm, or a share repurchase.

In terms of a partial exit, there could be a private placement, where another investor purchases a piece of the business. Another possibility is corporate restructuring, where external investors get involved and increase their position in the business by partially acquiring the private equity firm’s stake. Finally, corporate venturing could happrivaten, in which the management increases its ownership in the business.

Lastly; a flotation or an IPO is a hybrid strategy of both total and partial exit, which involves the company being listed on a public stock exchange. Typically, only a fraction of a company is sold in an IPO, ranging from 25% to 50% of the business. When the company is listed and traded publicly, private equity firms exit the company by slowly unwinding their remaining ownership stake in the business

CUSTOMER SUPPORT 9607619191

CUSTOMER SUPPORT 9607619191