CGTMSE – Credit Guarantee Trust for Medium & Small Enterprises

CGTMSE – Credit Guarantee Trust for Medium & Small Enterprises

A Tool to Promote MSE Growth & Innovation

What is the CGTMSE Scheme?

The whole idea behind this trust is to provide financial assistance to industries without any third-party guarantee or collateral. It is a scheme introduced by the Government of India in association with SIDBI. As per this scheme, a loan of up to Rs. 200 lakhs can be given to MSMEs. The scheme provides assurance to the lenders that in case of default, a guarantee cover will be provided by the trust in the ratio of 50/75/80/85 percent of the amount so given. It is an initiative which allows lending institutions to provide loans to small and micro enterprises without the availability of collateral or security.

Salient Features:

How to Get a Loan Under the CGTMSE Scheme?

The objective of the CGTMSE is to enable the banks to look at small and micro businesses with objectivity and give more importance to the project viability and business model validation. To cover the loan under the CGTMSE scheme, the borrower has to pay an additional guarantee fee and service charge in addition to the interest charged by the bank. Current CGTMSE fee is payable at the rate of 1.5%. It is payable at 0.75% for North Eastern region including the state of Sikkim.

Procedure for CGTMSE Loan :

Step 1. Formation of the Business Entity

Before even starting the procedure for loan approval under CGTMSE, the borrower has to incorporate a private limited company, limited liability partnership, one person company, or a proprietorship according to the nature of the business and obtain necessary approvals and tax registrations for executing the project.

Step 2. Business Plan

Borrowers need to conduct a market analysis and prepare a business plan containing relevant information, such as business model, promoter profile, projected financials, etc. The report is then presented to the credit facility and an application is filed for getting the loan under CGTMSE scheme. However, businesses should consider that such project reports be prepared by experienced professionals. This shall increase the chances of approval.

Step 3. Sanction for Bank Loan

The request for bank loan usually contains credit term and working capital facilities. After the application and business plan are under process, banks carefully analyses the viability of business model and process the loan application and accord sanction, as per the bank’s policy.

Step 4. Obtaining the Guarantee Cover

After the loan is sanctioned the bank applies to CGTMSE authority and obtains the guarantee cover. If the loan is approved by CGTMSE, the borrower will have to pay the guarantee fee and service charges. The CGTMSE loan application form can be downloaded from its official website.

The extended list of MLIs under the CGTMSE scheme contains 141 banks including all the major rural, urban, public sector banks, and private sector banks of India. The list contains some of the larger banks, such as State Bank of India, United Bank of India, Punjab National Bank, etc.

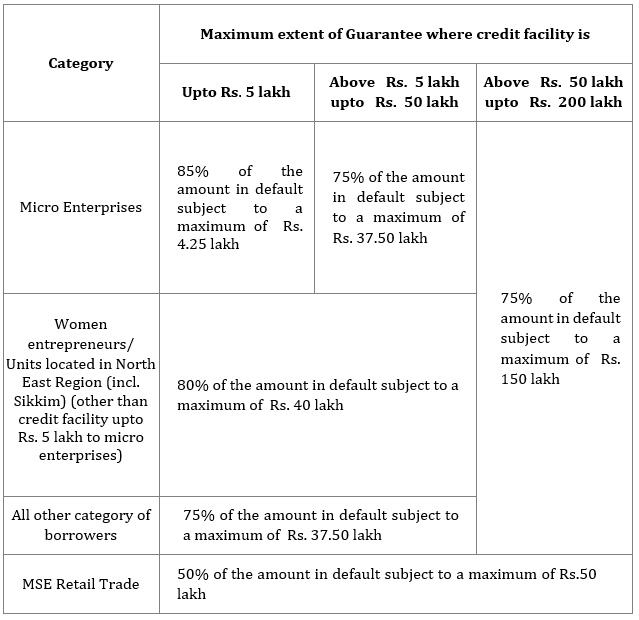

Extent of the cover under CGTMSE

Fee Structure

Which enterprises can avail the CGTMSE fund?

The enterprises which are eligible for this scheme are:

-

New as well as existing Micro, Small and Medium enterprises who are engaged in the process of;

a. Manufacturing activity

b. Service activity, except:

i. Retail Trade.

ii. Educational Institutions.

iii. Self Help Groups.

iv. Training Institutions.

It is now available for selected NBFC’s also

Documents Required

KYC Documents

-

PAN Card & Aadhar Card

-

Proof of Address: Electricity Bill / Registered Rent Agreement

-

Shop Act, GST Registration Certificate, Udyog Aadhaar

-

MOA & AOA, Certificate of Incorporation, Certificate of commencement of business

-

Last 3 years Income Tax Returns and Financial Statements

-

Last 1-year bank statement

-

Details of all existing loans Sanction Letter and Loan Account Statement for last 1 year.

Income Documents

- By Pratik Vanjari

CUSTOMER SUPPORT 9607619191

CUSTOMER SUPPORT 9607619191