ANGEL INVESTORS

ANGEL INVESTORS

Who is an Angel Investor?

An Angel Investor is someone who infuses their own funds during the early stage of a company and also contributes through their business experience. These are usually wealthy individuals who either invest in the personal capacity or through crowd funding platforms online or build an angel investor’s network, to pool in capital together and then invest in early-stage startups in which they have a personal liking to a product or where they find the business idea compelling enough to become a big success.

Types of Angel Investors :

1. Family and Friends: :

This is the most common source of funding for startups usually when startups begin to look for finance.

2. Wealthy Individuals:: :

Businessmen, doctors, lawyers or such other individuals having a high net worth and are willing to invest capital in return for equity in startups.

3. Groups Angels: :

Various angels are increasingly operating as part of an angel syndicate (a group of angel investors), which raise their potential investment level accordingly.

4. Crowd Funding: :

It is a form of an online investing group. Crowd funding involves raising funds by having large groups of individuals invest amounts as small as $100.

5. Domain Investors: :

Investors in this category are usually operating executives who have spent their entire careers in a specific industry vertical, like internet travel, for example. .

6. Super Angles: :

Super angels share some characteristics of both angel investors and venture capitalists. Super Angels Helps for Venture Financing of next round and vast network portfolio CFO’s which can tapped into for connection and help.

Advantages of using Angel Investors:

Disadvantages of using Angel Investors:

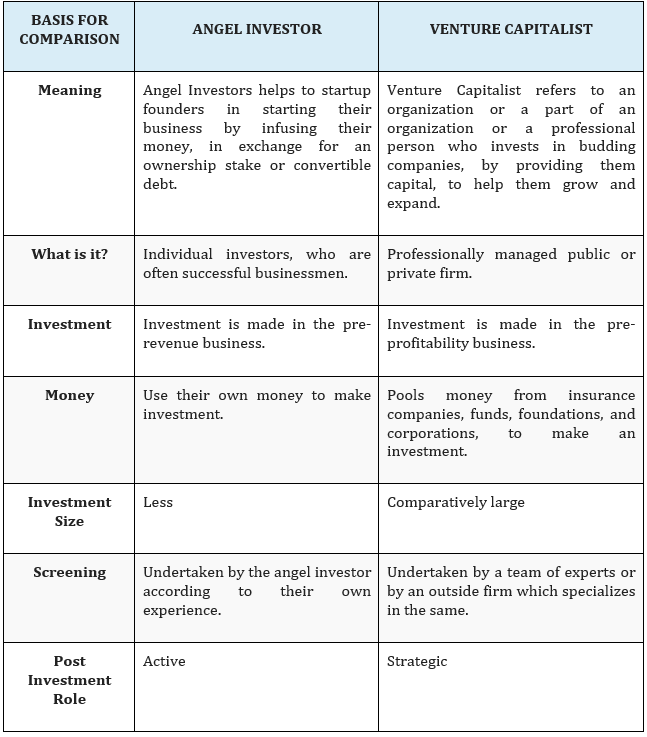

Difference between Angel investors and Venture Capitalist:

- By Priti Pagare

CUSTOMER SUPPORT 9607619191

CUSTOMER SUPPORT 9607619191