CIBIL

CIBIL

CIBIL

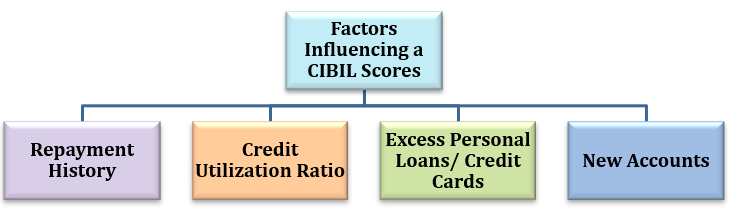

A CIBIL score is a consumer’s credit score. Simply, this is a three-digit numeric summary of consumer’s credit history and a reflection of the person’s credit profile. This rating is based on the past credit behavior, such as borrowing and repayment habits as shared by banks and other lenders with Credit Information Bureau (India) Limited (CIBIL) on regular basis. CIBIL score ranges from 300 to 900, with 900 being the highest and 300 being the least. Banks and financial institutions prefer extending credit facility to an individual whose credit score is 700 or more. Individuals with a good Credit Score are less likely to commit default on their loan payments.

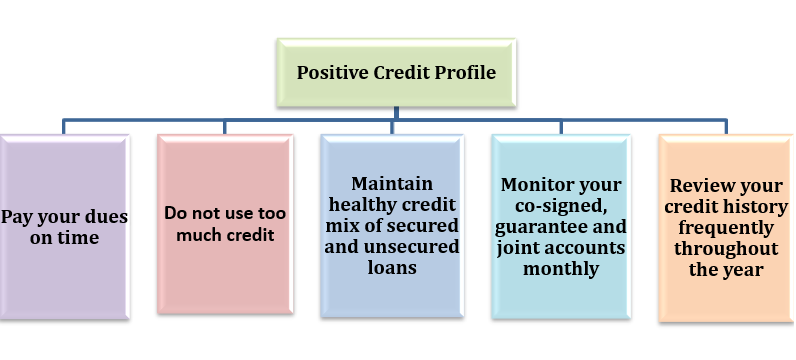

How you can work towards a Positive Credit Profile?

Importance of Obtaining Good Credit Scores

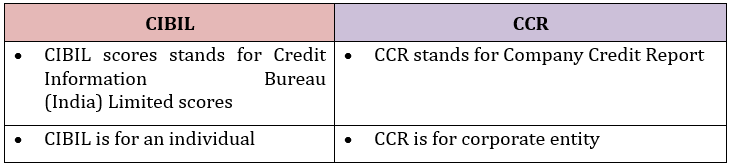

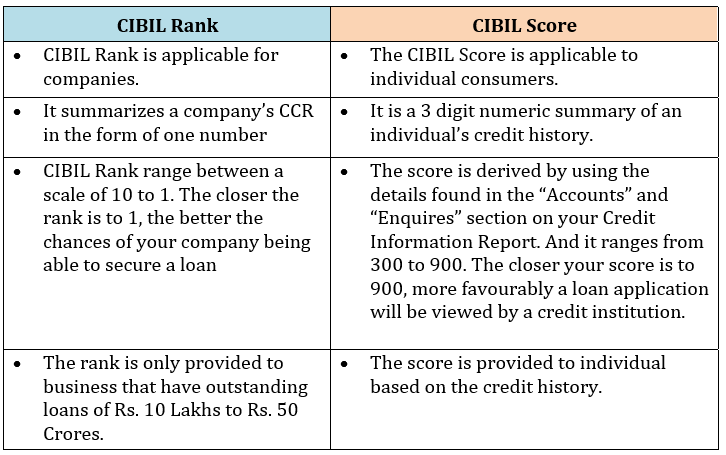

In order to avail an unsecured business loan, the credit score of that particular individual must be over 700, manditorily. If the application is made for a secured business loan, the credit score could be ranging between 600 to 700. However, if the applicant is not an individual but an entity or a body corporate (Partnership firm, Limited Liability Partnership Firm or Private Limited Company) the business Credit Score (CIBIL Rank) and Company Credit Report (CCR) play a major role apart from the personal credit score in loan approval process

Difference between CIBIL & CCR

Differece between CIBIL Rank & CIBIL Score

A positive credit profile can make you a good bet for the lender and pave the wave for access to credit.

- By CS Raksha Sharma

CUSTOMER SUPPORT 9607619191

CUSTOMER SUPPORT 9607619191