MUDRA - Micro Units Development and Refinance Agency Limited

The launch of Pradhan Mantri MUDRA Loan Scheme in April 2015, aims to provide Collateral-free Loans upto Rs. 10 Lakhs to small businesses engaged in economic activities like retail, manufacturing, trading etc.

TYPES OF MUDRA LOAN:

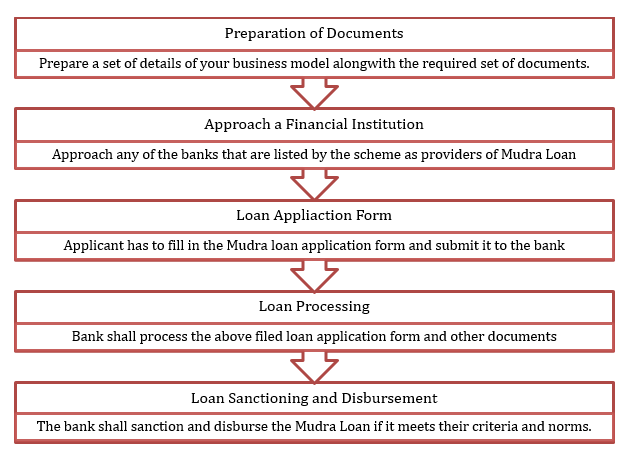

Procedure for application of MUDRA

Eligibility Criteria

-

Loan applicant must be an Indian Citizen

-

Loan can be availed only for micro or small scales businesses rural areas.

-

Loans can be availed by non-farm income-generating businesses in trading, manufacturing and services.

-

Loan amount should be quoted under the maximum limit Rs. 10,00,000/-

Documents Required

-

Identity proof, Residence proof, and Business address proof

-

Income Tax Returns and Financial Statements of last three years

-

Written proposal of Company or Partnership Deed

-

Latest Assets and Liabilities statement and income tax returns of promoters and Guarantors.

-

Rental agreement (if any)

-

Registration forms of SSI/MSME, if applicable.

-

Projected Financial Statements for the coming two, for cases involving Rs. 2 lakhs and above.

Benefits of Attaining MUDRA Loan

-

Finance range : Rs. 50, 000 to Rs.10,00,000/-

-

No processing fee

-

Focus on small and micro level businesses

-

Low Interest rates

- By Harshali Ahire

CUSTOMER SUPPORT 9607619191

CUSTOMER SUPPORT 9607619191