PMEGP

Prime Minister’s Employment Generation Programme (PMEGP) is a credit-linked subsidy programme provided by the Government to eligible individuals/entities in order to produce employment opportunities in urban and rural areas.

Who can apply?

-

Individuals with minimum age of 18 years

-

Individuals must have passed at least Class VIII of schooling, if they want to establish a manufacturing unit costing over Rs. 10 lakh or a service unit costing over Rs. 5 lakh

-

Self-help Groups (SHGs) & Charitable Trusts comes under eligible entities to avail loans under PMEGP scheme.

-

Societies that are registered under Societies Registration Act, 1860

-

Production Co-operative Societies

Other Details:

-

There is no income ceiling

-

Loans are offered to new units and are not available for existing units established under PMRY, REGP or any other government scheme.

-

Any unit that has availed subsidy under any other scheme is not eligible for the PMEGP loan.

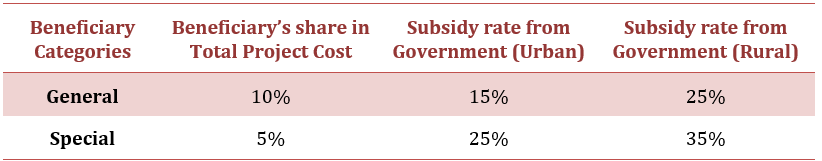

Subsidy:

Funding: The balance amount of the total project cost is provided by the banks as a term loan (PMEGP loan) to the micro unit entrepreneur.

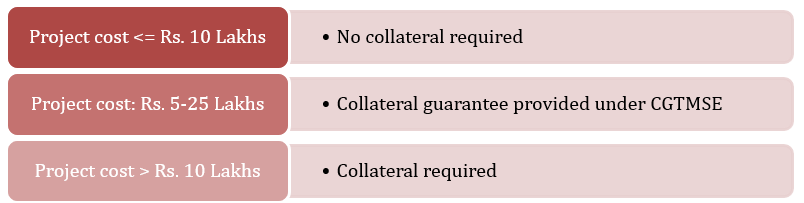

Does a PMEGP loan require Collateral?

Documents Required:

-

Project report

-

Duly filled application form with passport sized photographs

-

Applicant’s Identity & Address Proofs

-

Applicant’s PAN card, Aadhaar card & VIII Pass certificate

-

Special category certificate, if required

-

Certificate of Entrepreneur Development Programme (EDP) training

-

Certificate for SC/ST/OBC/Minority/Ex-Servicemen/PHC

-

Certificate of academic and technical courses, if any

-

Any other document required by the bank or NBFC

Other Loan Details:

-

Rate of Interest:- The rate of interest on the PMEGP loan will be at a normal rate as applicable to the MSE sector.

-

Tenure of the PMEGP Loan: After an initial moratorium (that usually does not exceed 6 months), the bank may provide a repayment schedule of 3 years for the borrowers to pay back the PMEGP loan.

-

Margin Money / Subsidy: margin money is kept in a separate savings account that is linked to the loan account, and locked in for a period of 3 years, after which it is adjusted with the PMEGP loan or released .

-

Working Capital Requirements: The PMEGP loan requires that the working capital expenditure be equal to the cash credit limit at least once in the three years after the margin money is locked in. Moreover, it should not be less than 75% utilization of the sanctioned limit.

-

Indicative Sectors for Which Business Loan under PMEGP Scheme is Given: The PMEGP loan is given for enterprises in the following sectors:

1.Agro-based Food Processing

2.Forest-based Products

3.Hand Made Paper and Fiber

4.Mineral-based Products

5.Polymer and Chemical-based Products

6.Rural Engineering and Bio-Tech

7.Service and Textile

- By Bhaktija Dange

CUSTOMER SUPPORT 9607619191

CUSTOMER SUPPORT 9607619191