Financial Planning – The 50/30/20 Rule

Financial Planning – The 50/30/20 Rule

Financial Planning – The 50/30/20 Rule

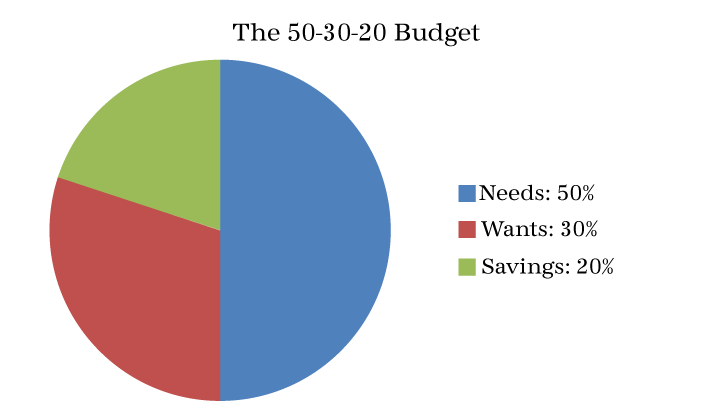

The 50/30/20 is a golden thumb rule for financial planning of your income earned. It is very important to plan on how you expend your money! This rule is a guideline to allocate your budget into to three categories :

Allocation of Income : 50% to Needs:

Needs are basic necessities and expenses that you cannot live without such as

-

Housing Rent

-

Food

-

Groceries

-

Basic Utilities (Electricity, Water, Gas)

-

Child care

-

Health Insurance

-

Debt Payments

-

Transportation

-

Dining Out

-

Shopping

-

Debt Payments

-

Travel and Vacation

-

Gym Membership

-

Entertainment (Cinema, Netflix, Hobbies)

-

Investment in SIPs, Securities Market, etc.

-

Real Estate

-

Emergency Fund

-

Retirement Plan

30% to Wants

Wants refer to desires and wishes which are not necessary for your survival

20% to Savings, Investments and Financial Goals

Savings and Investments help you achieve your Financial Goals and secure your future.

How to apply the 50-30-20 Rule : a step-by-step-guide

1. Calculate your monthly post tax income

2. Categorise your expenses into Needs, Wants and Savings

3. Allocate your income and spend accordingly

4. Strictly follow and stick to the above Guidelines

- By Drumil Shere

CUSTOMER SUPPORT 9607619191

CUSTOMER SUPPORT 9607619191